#HDI (High Density Interconnect) PCB

Explore tagged Tumblr posts

Text

HDI (High Density Interconnect) PCB

HDI (High Density Interconnect) is a high density interconnect technology that enables more tracks and interconnect through holes. Compared to traditional circuit boards, HDI technology can achieve more functions in a smaller size.

0 notes

Text

https://www.maximizemarketresearch.com/market-report/global-high-density-interconnect-hdi-pcb-market/30122/

Growing consumer electronics sales, as well as a significant increase in demand for HDI PCBs in these applications, are driving the global HDI PCB market.

0 notes

Text

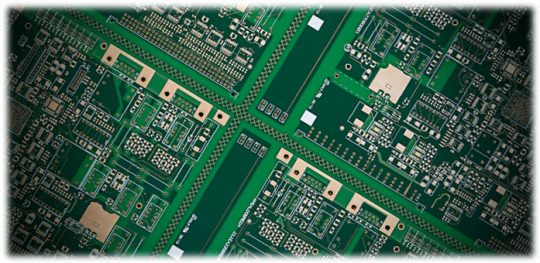

10 layers high density interconnect PCB board made of FR-4, Tg 150 with immersion gold surface treatment.

High-Density Interconnect (HDI) PCB is simply a PCB with more number of interconnections and buried hole, blind hole, occupying minimal space. This results in the miniaturization of the circuit board. The components are placed closer and the board space is significantly reduced but the functionality isn’t compromised. [email protected]

4 notes

·

View notes

Text

This is a picture of a 10-layer ELIC HDI PCB Board. The PCB board utilizes high-density interconnect technology, resulting in smaller dimensions and higher signal transmission efficiency. Its intricate layer-to-layer connection design makes it suitable for high-performance electronic devices and communication systems.

www.hitechcircuits.com www.hitechpcb.com

6 notes

·

View notes

Text

PCB Fabrication Company in India – Reliable Solutions for Your Manufacturing Needs

Printed Circuit Boards (PCBs) are the foundation of modern electronics. From mobile devices to industrial equipment, PCBs are essential in powering technology across industries. As demand for high-quality electronics continues to rise, India has become a global hub for PCB fabrication, offering reliable, affordable, and advanced manufacturing solutions.

If you are looking for trusted PCB fabrication company in India, FindingMFG connects you with verified manufacturers ready to deliver quality at every stage of production.

Why Work with a PCB Fabrication Company in India?

India has established itself as a leading destination for electronics manufacturing. Supported by skilled professionals, modern infrastructure, and global certifications, Indian PCB manufacturers deliver products that meet international standards. Here’s why businesses choose PCB fabrication companies in India:

Affordable and Efficient Production

PCB manufacturers in India provide cost-effective solutions, whether you require a prototype or a large-volume order. Competitive pricing combined with strict quality control ensures that you receive reliable products at the right cost.

Advanced Manufacturing Capabilities

With access to modern machinery and production techniques, Indian PCB companies can fabricate single-sided, double-sided, and multilayer boards. They can handle standard designs as well as complex, custom configurations.

Customized Services for Every Requirement

Indian manufacturers specialize in tailored PCB solutions to match your exact project needs. From design specifications to delivery timelines, they offer flexibility for both small and large production runs.

Commitment to Global Standards

Leading PCB fabrication companies in India hold international certifications such as ISO, IPC, UL, and RoHS. These certifications guarantee that every board produced meets high-quality benchmarks for global markets.

Comprehensive PCB Fabrication Services

At FindingMFG, you can easily connect with PCB manufacturers offering a wide range of services, including:

Single-Sided PCBs

Double-Sided PCBs

Multilayer PCBs

Flexible and Rigid-Flex PCBs

High-Density Interconnect (HDI) PCBs

Metal Core PCBs

High-Frequency PCBs

Whether your project is straightforward or highly complex, India’s PCB manufacturers have the capabilities to deliver.

Industries Served by PCB Fabrication Companies in India

Indian PCB manufacturers serve a broad range of industries, including:

Automotive

Aerospace and Defense

Consumer Electronics

Telecommunications

Medical Devices

Industrial Automation

IoT and Smart Technology

This industry expertise allows them to provide solutions that meet the specific needs of diverse applications.

FindingMFG – Connecting You with the Right PCB Fabrication Partner

FindingMFG is India’s trusted online platform for sourcing electronics manufacturing services. We help you discover reliable, verified PCB fabrication companies in India, simplifying the process of finding the right supplier for your project.

What FindingMFG Offers:

Verified suppliers across India

Easy-to-use search filters

Fast, direct quote requests

Transparent communication with manufacturers

Solutions for domestic and international buyers

Start Your PCB Manufacturing Project Today

Choosing the right PCB fabrication partner is a critical step toward building successful electronic products. With FindingMFG, you gain access to India’s best manufacturers who can deliver quality, precision, and value.

Post your requirement on FindingMFG and connect with trusted PCB fabrication companies in India.

Visit FindingMFG.com to get started

#pcb fabrication company#pcb fabrication companies in India#pcb design#pcb manufacturing#manufacturing directory

0 notes

Text

Comprehensive Guide to PCB Board Design & Printed Circuit Assembly for Optimal Electronic Performanc

Compre

Modern electronics rely heavily on printed circuit boards (PCBs). Without well-designed PCBs and quality assembly, devices can become unreliable or fail prematurely. Whether you’re a designer or manufacturer, understanding how to create and assemble high-quality PCBs is crucial. This guide covers essential design principles, manufacturing methods, testing, and tips for better PCB performance.

Understanding PCB Board Design Fundamentals

The Role of PCB Design in Electronics Functionality

PCB design is the blueprint that shapes how your device works. It directly influences electrical signals, heat management, and overall durability. Poor design can lead to issues like signal interference or overheating, hurting the product's performance. Good design results in a more reliable, longer-lasting device that customers can count on.

Essential Components of a PCB Design

A PCB isn’t just a green board with some wires. It includes multiple elements such as:

Layers: These are the different sheets of the PCB, repeating signals or power.

Traces: Thin lines of copper that connect components.

Pads: Contact points for mounting parts like chips or resistors.

Vias: Small holes that link traces on different layers.

Components: Resistors, capacitors, ICs, and other parts attached to the board.

Each piece affects how well the circuit functions. Proper layout and placement ensure electrical signals flow smoothly and the device functions as intended.

Designing for Manufacturing (DFM) Best Practices

Designing with manufacturing in mind helps lower costs and speeds up production. Here are key tips:

Use standard component sizes and footprints.

Keep traces wide enough to handle current.

Avoid tiny vias or complex shapes that are hard to manufacture.

Place components logically to reduce assembly time.

Minimize the number of layers if possible. Fewer layers often mean lower costs.

These practices make it easier for factories to produce your design without errors or delays.

Types of Printed Circuit Boards and Their Applications

Rigid PCBs

Rigid PCBs are the most common type. They’re made of solid material, like fiberglass, that keeps the board stiff. You’ll find these in everything from computers to appliances. They’re reliable, cost-effective, and easy to handle during assembly.

Flexible and Rigid-Flex PCBs

Flexible PCBs bend and fold, fitting into small spaces inside devices. Rigid-flex combines both types, offering stiffness where needed and flexibility elsewhere. These are popular in wearable tech and smartphones, where space is tight.

High-Frequency and HDI PCBs

Special boards designed for fast signals — known as high-frequency PCBs — are used in radio, radar, and satellite systems. HDI (High-Density Interconnect) PCBs pack more components into less space, ideal for miniaturized electronics like medical devices or smartphones.

The Printed Circuit Assembly (PCA) Process

From Design to Production: Step-by-Step Overview

A typical PCA process includes:

Designing the circuit using CAD tools.

Verifying the design for errors.

Creating prototypes for testing.

Moving into full-scale manufacturing.

Assembling components via soldering.

At every step, quality checks are essential to prevent costly mistakes later.

Key Manufacturing Techniques

Surface-Mount Technology (SMT): Attaching components on the surface. It’s fast and suitable for high-volume production.

Through-Hole Assembly: Inserting pins into drilled holes. Best for parts needing full mechanical strength.

Automated Assembly: Robots place components quickly with high precision.

Manual Assembly: Used for small runs or complex parts, but slower.

Choosing the right method impacts the speed and quality of your PCB production.

Quality Control and Inspection

Regular inspections catch problems early:

X-ray Inspection: Checks hidden solder joints.

Automated Optical Inspection (AOI): Finds defects on the surface.

SPI (Solder Paste Inspection): Ensures correct solder paste volume.

Complying with standards like IPC-610 and IPC-2221 helps keep quality high and consistent.

Critical Factors Influencing PCB and PCA Quality

Material Selection for Durability and Performance

Choosing the right materials makes a difference:

Substrates like FR-4 are common but vary in quality.

Copper thickness affects current capacity.

Solder masks prevent shorts and corrosion.

Durable materials stand up to temperature, vibration, and environmental stress.

Design for Reliability

To keep your device working long-term:

Minimize electrical interference by proper grounding.

Manage heat by placing heat-sensitive parts away from heat sources.

Use clear labels and ample space for easy assembly and maintenance.

Good practice prevents failure and reduces warranty repairs.

Environmental Considerations

PCBs face many conditions:

Use conformal coatings to protect from moisture.

Choose vibration-resistant designs for mobile devices.

Select temperature-tolerant materials for harsh environments.

Designing for these factors enhances lifespan and performance.

Cost Optimization

Balancing quality with budget is key:

Use standard components rather than custom parts.

Avoid overly complex designs.

Optimize layout for easy assembly.

Good planning reduces waste and keeps costs in check.

Best Practices for PCB Design and Assembly Optimization

Design Tips for Ease of Assembly

Properly space components for automatic placement.

Use clear silkscreen labels to identify parts.

Keep copper traces away from component pads for easier soldering.

Simplicity saves time during manufacturing and reduces errors.

Enhancing Manufacturing Efficiency

Stick to standard footprints.

Avoid intricate shapes on copper traces.

Use consistent pad sizes and pad-to-component spacing.

This approach speeds up production and keeps quality high.

Post-Assembly Testing and Validation

Once assembled, testing is crucial:

Conduct functional testing to verify operation.

Use burn-in tests to detect early failures.

Carry out long-term stress tests for durability.

Thorough testing ensures your product withstands real-world use.

Collaborating with Proven PCB Manufacturers

Choose manufacturers with:

Certifications like IPC-6012 or ISO 9001.

Experience in your specific PCB type.

Good communication and ability to meet deadlines.

Partnering with reliable suppliers reduces risks and improves final product quality.

Case Studies and Real-World Examples

Some companies have achieved great results by focusing on PCB design. For example, an electronics firm reduced their device failure rate by improving trace routing and component placement. Conversely, poor design choices, such as crowded traces, led to short circuits and costly recalls. Learning from these stories highlights the importance of meticulous planning and quality control.

Conclusion

Creating a high-performance PCB, from design to assembly, is essential for reliable electronics. Focus on good design practices, choose the right materials, and work with experienced manufacturers. Regular testing and inspection help catch issues before products hit the market. As technology advances, keep an eye on trends like miniaturization and high-frequency PCBs. Staying current ensures your designs remain competitive and durable. Quality now means better devices, happier users, and fewer headaches later.

0 notes

Text

Top 15 PCB Board Manufacturers in USA

When it comes to building reliable electronics, choosing the right PCB board manufacturer in USA is critical. Whether you’re a startup, engineer, OEM, or tech company, having a dependable partner for printed circuit board fabrication and assembly ensures faster production, fewer errors, and better results.

In this blog, we list the Top 15 PCB board manufacturers in the USA known for high-quality PCB fabrication, assembly, and fast delivery. These companies are widely searched and trusted across various industries — from medical to aerospace, IoT, automotive, and industrial applications.

1. PCB Power

PCB Power is one of the most trusted names among PCB board manufacturers USA. With over two decades of industry experience, PCB Power offers quick-turn PCB fabrication, full turnkey assembly, and components sourcing — all under one roof.

As a USA-based PCB company, they focus on delivering high-quality single, double, and multilayer PCBs with fast turnaround and competitive pricing. Whether you’re building prototypes or mass production, PCB Power’s online ordering system makes it easy to get instant quotes, track orders, and communicate with real engineers.

Key Features:

US-based production for fast and reliable delivery

ISO-certified processes for superior quality

Advanced manufacturing for high-density, multilayer PCBs

Turnkey assembly and BOM handling

Expert support for startups, engineers, and OEMs

If you’re looking for a complete PCB manufacturing solution in the USA, PCB Power should be your first stop.

2. Advanced Circuits

Advanced Circuits is one of the largest and oldest PCB manufacturers in the United States. Known for high-quality prototypes and low-to-medium volume production, they serve industries like aerospace, defense, and telecom.

They offer same-day and next-day shipping options and have their own in-house manufacturing for consistent quality.

3. Sierra Circuits

Sierra Circuits is a full-service PCB company specializing in quick-turn fabrication and assembly. They’re well-known for their high-performance HDI PCBs, rigid-flex boards, and support for complex designs. Sierra Circuits is ideal for companies looking for technical precision and tight tolerances.

4. Sunstone Circuits

Sunstone Circuits has built a reputation for delivering reliable prototype PCBs and small-batch orders. Their online design tools and instant quote system are ideal for hobbyists, startups, and small engineering teams. Their US-based manufacturing ensures high quality and fast shipping.

5. Bay Area Circuits

Located in California, Bay Area Circuits serves the Silicon Valley tech community with rapid prototyping, fabrication, and assembly services. They are experts in small-run production and serve various industries including medical, aerospace, and communications.

6. Rush PCB Inc.

Rush PCB Inc. offers full turnkey PCB services, including design, manufacturing, and assembly. They specialize in multilayer, flex, and rigid-flex PCBs with quick-turn options. Their experienced team supports everything from prototypes to volume production.

7. Custom Circuit Boards

Based in Arizona, Custom Circuit Boards provides high-quality PCBs for engineers and hardware startups. They focus on fast production and specialize in multilayer boards, thick copper PCBs, and RF designs.

8. Imagineering Inc.

Imagineering Inc. offers both PCB fabrication and assembly with ISO 9001 and AS9100 certifications. They serve demanding industries like medical and aerospace and are known for excellent quality and fast lead times.

9. Epec Engineered Technologies

Epec is a full-service provider offering custom PCB manufacturing, flexible circuits, and battery packs. With decades of experience, they provide engineered solutions for complex applications and tight deadlines.

10. APCT Inc.

APCT is known for high-speed, high-density interconnect PCBs. They support quick-turn and production-scale manufacturing. Their specialties include aerospace and defense-grade boards with rigorous quality requirements.

11. OnBoard Circuits

OnBoard Circuits offers affordable PCB prototyping, fabrication, and assembly with domestic and offshore capabilities. They are known for great customer support and fast delivery for small to medium volume orders.

12. Millennium Circuits Limited (MCL)

MCL provides reliable PCBs including rigid, flex, and rigid-flex boards. They serve industries like telecom, industrial, and medical, offering fast turnaround times and excellent pricing.

13. TechnoTronix

TechnoTronix offers advanced PCB manufacturing and assembly solutions with a strong focus on precision and fast lead times. They work with both small businesses and large enterprises, offering everything from basic to complex PCB designs.

14. RedBoard Circuits

RedBoard Circuits provides quality PCBs with a focus on customer service and quick delivery. They offer a wide range of PCB types including FR4, aluminum, and Rogers materials.

15. ALLPCB USA

ALLPCB USA offers cost-effective PCB solutions with a quick-turn focus. They provide both prototype and production runs and serve customers looking for affordable yet reliable circuit boards.

Choose the Best PCB Manufacturer for Your Needs

Selecting the right PCB board manufacturer in USA can be the difference between a successful project and costly delays. Whether you need fast prototyping, volume production, or full turnkey PCB assembly, each of these top 15 manufacturers brings something unique to the table.

However, if you’re looking for a complete solution with fast delivery, reliable quality, and competitive pricing — PCB Power is a clear leader. With US-based manufacturing, expert support, and a user-friendly online ordering platform, PCB Power makes your PCB journey seamless from design to delivery.

0 notes

Text

Thin Double Sided FPC Market: Key Players, Competitive Analysis, 2025-2032

MARKET INSIGHTS

The global Thin Double Sided FPC market size was valued at US$ 2.73 billion in 2024 and is projected to reach US$ 4.78 billion by 2032, at a CAGR of 8.6% during the forecast period 2025-2032. While the U.S. market accounted for 28% of global revenue in 2024, China is expected to witness the fastest growth with a projected CAGR of 7.9% through 2032.

A thin double-sided flexible printed circuit (FPC) is a specialized circuit board that combines enhanced flexibility with double-sided micro-wiring capabilities through an ultra-thin substrate (typically under 0.1mm thickness). These advanced PCBs reduce mechanical stress and bias force while maintaining high-density interconnects, making them ideal for compact electronic devices. Key material variations include gold-plated (accounting for 42% market share) and copper-plated (38% share) configurations, each offering distinct conductivity and durability characteristics.

The market growth is primarily driven by expanding applications in consumer electronics (58% of 2024 demand), particularly smartphones and wearables requiring lightweight, bendable circuitry. Furthermore, automotive electrification trends are creating new opportunities, with FPCs increasingly used in advanced driver-assistance systems (ADAS) and in-vehicle infotainment. Recent technological developments include Nitto Denko’s 2023 launch of a 25μm ultra-thin FPC with improved heat resistance, addressing growing thermal management requirements in 5G devices. Market leaders Nippon Mektron and Sumitomo Electric continue to dominate, collectively holding over 35% of global production capacity.

MARKET DYNAMICS

MARKET DRIVERS

Proliferation of Consumer Electronics to Spur Demand for Thin Double-Sided FPCs

The consumer electronics industry remains the largest end-user of thin double-sided flexible printed circuits (FPCs), accounting for over 60% of global demand. This dominance stems from the technology’s ability to enable miniaturization while maintaining reliability in smartphones, wearables, and tablets. With smartphone shipments projected to reach 1.2 billion units annually by 2025, manufacturers increasingly adopt thin double-sided FPCs for their space-saving advantages in high-density interconnect (HDI) designs. These circuits allow for complex multilayer routing in constrained spaces – a critical requirement as device thickness continues to decrease while functionality expands. Recent innovations in gold-plated FPCs offer enhanced signal integrity, further driving adoption in premium consumer devices. The trend towards foldable displays has created additional demand, with FPCs enabling the necessary flexible connections between hinge components.

Automotive Electrification and ADAS Adoption Accelerates Market Growth

Automotive applications represent the fastest-growing segment for thin double-sided FPCs, with demand escalating at nearly 15% CAGR. This surge correlates directly with the automotive industry’s rapid transition to electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Modern vehicles now incorporate over 100 FPCs on average, handling everything from infotainment systems to battery management. The thin double-sided variant proves particularly valuable in EVs where weight reduction is paramount – these circuits can be up to 70% lighter than traditional wiring harnesses while offering superior vibration resistance. Autonomous driving systems further compound demand, requiring high-reliability interconnects for sensors and cameras that must withstand harsh automotive environments. Major manufacturers have responded by developing automotive-grade FPCs with enhanced thermal and chemical resistance, opening new avenues for market expansion.

➤ Leading automotive suppliers have begun incorporating double-sided FPCs in battery monitoring systems, where their thin profile allows integration between cells while monitoring voltage and temperature with minimal space consumption.

MARKET RESTRAINTS

High Manufacturing Costs Limit Adoption in Price-Sensitive Markets

Despite their advantages, thin double-sided FPCs face significant adoption barriers due to production costs that can be 40-60% higher than single-sided alternatives. The sophisticated manufacturing process requires specialized equipment for precise laminating of ultra-thin substrates, along with advanced plating techniques to ensure reliability. This cost premium makes the technology less accessible for budget-oriented applications, particularly in developing markets where price sensitivity remains high. While material innovations continue to drive costs down, the gap remains substantial enough to limit market penetration in mid-range consumer products and industrial applications where cost often outweighs performance benefits.

Technical Challenges in High-Frequency Applications Hinder Wider Implementation

As electronic systems push toward higher frequencies to support 5G and millimeter-wave applications, thin double-sided FPCs face signal integrity challenges. The very thin dielectric layers that enable flexibility can lead to increased crosstalk and insertion losses at frequencies above 10GHz. This poses particular difficulties for RF applications in telecommunications infrastructure and advanced radar systems. While manufacturers have developed specialized materials with low dielectric loss tangents, these premium solutions come at substantially higher costs. The industry continues to grapple with balancing electrical performance, mechanical flexibility, and economic feasibility in next-generation applications.

MARKET OPPORTUNITIES

Medical Electronics Emerges as High-Growth Vertical for Thin Double-Sided FPCs

The medical device sector presents substantial untapped potential, with the global medical electronics market projected to exceed $80 billion by 2027. Thin double-sided FPCs are increasingly specified for implantable devices and wearable medical monitors where flexibility and reliability are paramount. Applications range from cochlear implants to continuous glucose monitors, where the technology’s biocompatibility and fatigue resistance offer distinct advantages. Recent regulatory approvals for novel medical wearables have accelerated development cycles, prompting manufacturers to develop medically-certified FPC solutions with enhanced durability and sterilization compatibility. The trend toward minimally invasive surgical tools also creates demand for ultra-thin FPCs that can navigate tight anatomical spaces while maintaining signal integrity.

Roll-to-Roll Manufacturing Breakthroughs Promise Cost Reductions

Emerging roll-to-roll (R2R) production techniques could significantly lower thin double-sided FPC manufacturing costs while improving yield rates. Current batch processing methods limit throughput and contribute to material waste, but continuous R2R approaches demonstrate potential for 30-40% cost reductions at scale. Several industry leaders have made substantial R&D investments in this area, with pilot production lines already demonstrating promising results for consumer applications. Successful commercialization of these methods could dramatically improve the economic viability of thin double-sided FPCs, potentially opening new application areas in IoT devices and smart packaging where cost has previously been prohibitive.

MARKET CHALLENGES

Supply Chain Vulnerabilities Impact Material Availability

The thin double-sided FPC market faces ongoing supply chain challenges, particularly for specialized polyimide substrates and high-performance adhesives. Over 70% of polyimide production remains concentrated in a limited number of facilities, creating bottlenecks during periods of high demand. Recent geopolitical tensions have exacerbated these issues, with trade restrictions affecting material flows between key manufacturing regions. Manufacturers must navigate extended lead times while maintaining inventory buffers – an expensive proposition given the high material costs. The situation has prompted some producers to explore alternative substrate materials, though these alternatives often require extensive qualification processes that delay time-to-market.

Technical Workforce Shortage Constrains Production Scaling

Industry expansion faces significant headwinds from a global shortage of skilled technicians capable of operating advanced FPC manufacturing equipment. The specialized nature of thin double-sided FPC production requires extensive training in precision lamination, laser drilling, and micro-via plating processes. As veteran operators retire, manufacturers struggle to fill positions, with some reporting vacancy rates exceeding 20% for critical technical roles. This skills gap has forced companies to invest heavily in training programs while simultaneously slowing capacity expansion plans. The challenge is particularly acute in established manufacturing hubs where competition for skilled labor is most intense.

THIN DOUBLE SIDED FPC MARKET TRENDS

Rising Demand for Compact Consumer Electronics to Drive Market Growth

The global thin double-sided FPC market is experiencing robust growth, primarily driven by exponential demand for lightweight and compact consumer electronics. Smartphones, wearables, and foldable devices require high-density, flexible circuits to accommodate advanced functionalities while maintaining slim form factors. The consumer electronics segment currently accounts for approximately 52% of total market revenue, with projections indicating sustained growth at a CAGR of 8.4% through 2035. Furthermore, the miniaturization trend in IoT devices and portable medical equipment continues to accelerate adoption of these ultra-thin circuit boards.

Other Trends

Automotive Electronics Modernization

The automotive sector is witnessing a paradigm shift in electronic architecture, with thin double-sided FPCs becoming critical enablers for next-generation vehicle designs. Modern vehicles now incorporate over 70 electronic control units on average, each requiring reliable connectivity solutions. Flexible printed circuits provide the necessary durability to withstand vibration and thermal stresses in automotive environments. Market analysts project the automotive electronics segment to grow at 9.7% annually through 2030, fueled by increasing autonomous driving capabilities and electric vehicle production.

Material Innovation and Manufacturing Advancements

Material science breakthroughs are significantly enhancing the performance characteristics of thin double-sided FPCs. Recent developments in polyimide substrates with improved thermal conductivity (up to 2.5 W/mK) allow for better heat dissipation in high-power applications. Meanwhile, advanced plating techniques now enable copper trace thicknesses below 10μm while maintaining excellent conductivity. Manufacturing innovations such as roll-to-roll processing have increased production efficiency by 28% compared to traditional batch methods, contributing to cost reductions across the supply chain.

Geographic Market Expansion

Asia-Pacific continues to dominate the thin double-sided FPC market, representing about 63% of global production capacity. While China maintains leadership in volume manufacturing, Southeast Asian countries are emerging as competitive alternatives due to lower operational costs. North America and Europe are experiencing above-average growth rates (7.9% and 6.8% respectively) driven by demand for specialized aerospace and defense applications, where reliability and performance outweigh cost considerations.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Leaders Leverage Innovation and Strategic Partnerships to Maintain Dominance

The global thin double-sided FPC market features a moderately consolidated competitive landscape dominated by major Asian manufacturers, with Nitto Denko and Nippon Mektron collectively holding approximately 25% market share in 2024. These established players benefit from decades of experience in flexible circuit technology, vertically integrated manufacturing capabilities, and strong relationships with electronics OEMs.

While Japanese firms traditionally led this space, Korean and Chinese competitors like Sumitomo Electric and MFS Technology are rapidly gaining traction through aggressive pricing strategies and expanding production capacities. This shift reflects broader supply chain realignments as global electronics brands diversify their supplier base.

Recent industry developments show established players are responding to competitive pressures by: – Investing in advanced roll-to-roll manufacturing technologies for higher yields – Developing thinner substrates (below 25μm) for next-gen wearables and foldables – Expanding application-specific product lines for automotive and medical markets

Meanwhile, emerging Chinese manufacturers such as Shenzhen Baolifeng Electronic and JiangXi Redboard Technology are disrupting traditional value chains through localized production and shorter lead times, particularly for domestic smartphone makers.

List of Key Thin Double Sided FPC Manufacturers

Nitto Denko (Japan)

Nippon Mektron (Japan)

Sumitomo Electric (Japan)

DK-Daleba (South Korea)

Oki Electric Cable (Japan)

TATSUTA Electric Wire and Cable (Japan)

Meiko Electronics (Japan)

NOK Corporation (Japan)

Qdos (Singapore)

MFS Technology (Singapore)

Uniflex Technology (China)

Best Technology Co (China)

Shenzhen Meidear (China)

3G Technology Co (China)

DSBJ (China)

Segment Analysis:

By Type

Gold Plated Segment Leads Due to Superior Conductivity and Durability in High-Frequency Applications

The market is segmented based on type into:

Gold Plated

Subtypes: Electroplated Gold, Immersion Gold

Copper Plated

Subtypes: Rolled Annealed Copper, Electrodeposited Copper

Others

By Application

Consumer Electronics Segment Dominates Due to Rising Demand for Compact, Flexible Circuit Solutions

The market is segmented based on application into:

Consumer Electronics

Subtypes: Smartphones, Wearables, Tablets

Aerospace

Automotive Electronics

Others

By End-User

OEMs Segment Holds Significant Share Due to Direct Integration in Final Products

The market is segmented based on end-user into:

Original Equipment Manufacturers (OEMs)

Contract Manufacturers

Aftermarket Suppliers

Regional Analysis: Thin Double Sided FPC Market

North America The North American thin double-sided FPC market is driven by strong demand from the consumer electronics and aerospace sectors, particularly in the U.S., which accounts for the largest regional market share. Major manufacturers such as Nitto Denko and Sumitomo Electric have a strong presence here, leveraging advanced manufacturing technologies. The region benefits from high R&D investments—approximately $35 billion annually in semiconductor and electronics research—which fosters innovation in flexible circuitry. However, stringent environmental regulations and rising raw material costs pose challenges for suppliers. Nonetheless, the expansion of 5G and IoT applications continues to fuel demand for high-performance FPCs in smart devices and automotive electronics.

Europe Europe’s market is characterized by a focus on precision and sustainability, with key players like DK-Daleba and Meiko Electronics leading the adoption of eco-friendly manufacturing processes. The EU’s Circular Economy Action Plan has accelerated the shift toward recyclable materials in FPC production, particularly in Germany and France. The automotive electronics segment dominates due to the region’s emphasis on electric vehicles (EVs), where thin double-sided FPCs are critical for battery management systems. However, slower growth in consumer electronics and reliance on imports from Asia create supply chain vulnerabilities. Collaboration between academic institutions and manufacturers is helping bridge this gap through localized R&D initiatives.

Asia-Pacific As the largest and fastest-growing market, the Asia-Pacific region, led by China, Japan, and South Korea, accounts for over 65% of global FPC production. China’s market alone is projected to reach $2.8 billion by 2030, fueled by massive electronics manufacturing hubs and government subsidies for domestic players like Nippon Mektron and MFS Technology. The consumer electronics boom—driven by smartphones, wearables, and foldable devices—is the primary growth driver. However, intense price competition and overcapacity in low-tier FPCs have pressured margins. Southeast Asian nations like Vietnam and Thailand are emerging as alternative manufacturing bases, offering cost advantages and tax incentives for foreign investors.

South America South America remains a niche market, with Brazil as the primary adopter of thin double-sided FPCs for automotive and industrial applications. The region’s growth is hindered by economic instability, limited local expertise, and reliance on imported FPCs—particularly from China and the U.S. However, rising FDI in Brazil’s automotive sector, coupled with increasing demand for aftermarket electronics, presents opportunities. Local suppliers like DSBJ are partnering with global manufacturers to improve technical capabilities, though scaling remains slow due to infrastructure bottlenecks and currency fluctuations. The lack of standardized regulations further complicates market entry for foreign players.

Middle East & Africa This region shows long-term potential but limited current traction, with demand concentrated in Israel, Turkey, and the UAE. The automotive and aerospace sectors are the key adopters, though volumes are modest compared to other regions. JHDPCB and Shenzhen Baolifeng Electronic have begun supplying FPCs for defense and telecommunications projects, leveraging partnerships with local distributors. Challenges include high import dependency, underdeveloped supply chains, and low consumer electronics penetration. However, ongoing smart city initiatives—particularly in Saudi Arabia’s NEOM project—are expected to drive incremental demand for advanced FPCs in IoT and renewable energy applications.

Report Scope

This market research report provides a comprehensive analysis of the Global and regional Thin Double Sided FPC (Flexible Printed Circuit) markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global Thin Double Sided FPC market was valued at USD million in 2024 and is projected to reach USD million by 2032, growing at a CAGR of % during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (Gold Plated, Copper Plated, Others), application (Consumer Electronics, Aerospace, Automotive Electronics, Others), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis. The U.S. market size is estimated at USD million in 2024, while China is projected to reach USD million by 2032.

Competitive Landscape: Profiles of leading market participants including Nitto Denko, Nippon Mektron, Sumitomo Electric, DK-Daleba, and others, covering their product offerings, R&D focus, manufacturing capacity, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in flexible circuit manufacturing, material advancements, and evolving industry standards for thin double-sided FPCs.

Market Drivers & Restraints: Evaluation of factors driving market growth along with challenges, supply chain constraints, regulatory issues, and market-entry barriers.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities in the FPC market.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/fieldbus-distributors-market-size-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/consumer-electronics-printed-circuit.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-alloy-current-sensing-resistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modular-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/integrated-optic-chip-for-gyroscope.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/industrial-pulsed-fiber-laser-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/unipolar-transistor-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/zener-barrier-market-industry-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/led-shunt-surge-protection-device.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/type-tested-assembly-tta-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/traffic-automatic-identification.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/one-time-fuse-market-how-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pbga-substrate-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nfc-tag-chip-market-growth-potential-of.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silver-nanosheets-market-objectives-and.html

0 notes

Text

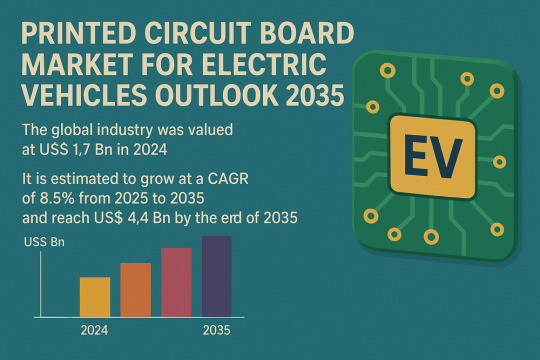

Smart Mobility Drives Smart PCBs: Market to Hit $4.4Bn by 2035

The global Printed Circuit Board (PCB) Market for Electric Vehicles (EVs) is set to witness significant expansion over the next decade, according to the latest market analysis. Valued at US$ 1.7 billion in 2024, the market is projected to grow at a CAGR of 8.5% from 2025 to 2035, reaching a valuation of US$ 4.4 billion by the end of the forecast period.

Market Overview: Printed Circuit Boards (PCBs) are the electronic backbone of electric vehicles, enabling power distribution, connectivity, and control across critical systems such as battery management, motor control, infotainment, and advanced safety features. With EV adoption accelerating globally, PCBs have become essential to the performance, reliability, and innovation of next-generation vehicles.

Market Drivers & Trends

One of the primary drivers of this market is the growing investment and strategic partnerships in the EV supply chain. Leading automakers and electronics companies are heavily investing in R&D and manufacturing capacity to meet the increasing demand for high-performance PCBs.

Moreover, the rise of autonomous and connected vehicles has made sophisticated electronics an indispensable part of modern transportation. The proliferation of features like ADAS (Advanced Driver-Assistance Systems), V2X communication, and in-vehicle infotainment is pushing the demand for compact, multi-layer, high-speed, and thermally efficient PCBs.

In 2023, EV sales in the U.S. surged by 60%, while the European Commission invested over US$ 6 billion in EV infrastructure further stimulating demand for advanced PCB solutions.

Latest Market Trends

The industry is witnessing a rapid shift toward flexible and high-density interconnect (HDI) PCBs, which are crucial for compact and space-saving vehicle designs. Flexible PCBs, in particular, are gaining traction in battery management systems and advanced sensor modules due to their lightweight and adaptable nature.

Additionally, regulatory advancements such as the FCC's allocation of the 5.9 GHz band for vehicle safety and autonomous functions have opened doors for new PCB capabilities. Real-time, high-speed data transmission requires advanced PCB materials and multi-layer configurations.

Key Players and Industry Leaders

Some of the most prominent players shaping the global printed circuit board market for electric vehicles include:

ABL CIRCUITS

AT&S Austria Technologie & Systemtechnik Aktiengesellschaft I

Chin Poon Industrial Co., Ltd.

Compeq Manufacturing Co., Ltd.

HannStar Board Corporation

Kinwong Electronic Co. Ltd

LG Innotek

MEIKO ELECTRONICS Co., Ltd.

Nan Ya Printed Circuit Board Corporation

RayMing PCB

Rush PCB Ltd.

SCHWEIZER ELECTRONIC AG

Shenzhen Capel Technology Co., Ltd.

Shenzhen Fastprint Circuit Tech Co., Ltd.

TTM Technologies

Unimicron Technology Corporation

Victory Giant Technology Co., Ltd.

WUS Printed Circuit Co., Ltd.

Young Poong Group

Zhen Ding Tech. Group

Among Others

These companies are prioritizing innovation, expanding global manufacturing footprints, and forging strategic alliances to maintain competitiveness and cater to evolving industry needs.

Download now to explore primary insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86464

Recent Developments

October 2024 – Mektech Manufacturing announced a 920 million baht investment in Thailand to expand production capacity for flexible PCBs and FPCBA used in electric vehicles.

July 2024 – Omron Electronic Components Europe launched a high-power PCB relay for Level 2 EV charging stations. The innovation features double-break contact designs, enabling reduced heat dissipation and enhanced energy efficiency.

Market Opportunities

The market is poised for significant opportunities, particularly in:

OEM collaborations to co-develop application-specific PCBs for power electronics and smart mobility.

Flexible PCB technology, which is expected to revolutionize EV design with lightweight, customizable circuit boards.

Geographical expansion into regions like South Asia and Latin America, where EV adoption is accelerating, and supply chains are emerging.

Additionally, the ongoing reshoring of PCB manufacturing in regions such as North America and Europe presents untapped potential for local players.

Future Outlook

According to analysts, the convergence of EV electrification, autonomy, and connectivity will demand ever more sophisticated PCB solutions. Next-generation EVs will require PCBs capable of managing 50 Gbps data speeds, robust thermal management, and high signal integrity. Flexible, multilayer, and ceramic PCBs are expected to gain ground rapidly.

As regulations around emissions and vehicle safety become more stringent, automakers will rely heavily on advanced PCB solutions to remain compliant and competitive. From battery optimization to smart in-vehicle systems, the demand for high-performance PCBs is set to skyrocket.

Market Segmentation

The global PCB market for EVs is segmented across several parameters:

By Type: Multilayer (dominant with 73.98% market share in 2024), Double-sided, Single-sided

By Substrate Type: HDI/Micro-via/Build-up, Flexible, Rigid-flex, Rigid 1-2 Sided

By Material: FR4, Metal-Based, Ceramic, PTFE, Power Combi-boards

By Application: ADAS, Battery Management, Powertrain, Lighting & Display, Charging, Connectivity, etc.

By Vehicle Type: Passenger Cars, Buses, Two-Wheelers, Trucks, Off-Highway Vehicles

By End Users: OEMs, Tier 1 & 2 Suppliers, Aftermarket

Regional Insights

East Asia is the undisputed leader in the global market, accounting for 68.3% of the total share in 2024. The region’s dominance stems from:

A well-established electronics manufacturing ecosystem

Government support for EV expansion and green technology

Cost-effective production and high R&D capabilities

Japan, South Korea, and China house the majority of leading PCB suppliers and EV component manufacturers. Their early investment in automation and material innovation is positioning East Asia as the global hub for EV electronics.

Other key regions include:

North America, driven by government initiatives like the CHIPS Act

Europe, focused on sustainable manufacturing and reducing supply chain reliance on Asia

South Asia, emerging as a low-cost, high-volume manufacturing zone

Why Buy This Report?

This in-depth industry report offers:

Detailed market sizing and forecast (2020–2035)

Comprehensive segmentation across product, material, vehicle type, and region

Competitive landscape with profiles of 20+ leading companies

Insights into trends, innovations, and regional dynamics

Strategic recommendations for stakeholders, investors, and policymakers

Whether you're an investor, OEM, component supplier, or policy planner, this report serves as a strategic guide to understanding growth dynamics and identifying emerging opportunities in the PCB market for electric vehicles.

Explore Latest Research Reports by Transparency Market Research: Active Optical Cable Market: https://www.transparencymarketresearch.com/active-optical-cables.html

3D Cameras Market: https://www.transparencymarketresearch.com/3d-cameras-market.html

Optoelectronics Market: https://www.transparencymarketresearch.com/optoelectronics-market.html

Machine Safety Market: https://www.transparencymarketresearch.com/machine-safety-market.html

DC-DC Converter OBC Market: https://www.transparencymarketresearch.com/dc-dc-converter-obc-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Electronic Manufacturing in Chennai — A Complete Industry Overview

If you’re exploring electronic manufacturing in Chennai, you’re looking at one of India’s fastest-growing and most dynamic industrial sectors. Chennai has emerged as a key hub for EMS (Electronics Manufacturing Services) and PCB design, attracting both domestic and international companies seeking quality, efficiency, and innovation.

This comprehensive overview will help you understand why Chennai is a preferred destination for electronics manufacturing, what the local industry offers, and how it can support your product development needs.

Why Chennai is a Leading Electronics Manufacturing Hub

Chennai’s rise as an electronics manufacturing center is driven by several unique advantages:

Strategic Location and Connectivity

Chennai offers excellent access to major ports like Chennai Port and Ennore Port, facilitating smooth import and export of components and finished goods. The city is well-connected via road, rail, and air to key markets across India and globally.

Skilled Workforce and Technical Expertise

Chennai is home to numerous engineering colleges and technical institutes that supply a steady stream of qualified engineers and technicians. This talent pool is well-versed in modern PCB design and electronics manufacturing processes, supporting innovation and quality.

Robust Infrastructure and Industrial Clusters

Dedicated electronics manufacturing zones, such as Sriperumbudur and Oragadam, host advanced industrial parks with reliable power, logistics, and facilities tailored for electronics production.

Government Support and Incentives

Tamil Nadu’s electronics manufacturing policy encourages investments through subsidies, incentives, and streamlined approvals. National initiatives like Production Linked Incentive (PLI) schemes further boost the sector.

Key Components of Electronic Manufacturing in Chennai

Electronics Manufacturing Services (EMS)

EMS companies in Chennai offer end-to-end manufacturing solutions, including:

Prototype development and New Product Introduction (NPI)

Printed Circuit Board Assembly (PCBA) with Surface Mount Technology (SMT) and Through-Hole Technology (THT)

Box build assembly and product integration

Testing, quality control, and compliance assurance

These companies serve diverse sectors such as consumer electronics, automotive, healthcare, industrial automation, and IoT devices.

PCB Design and Manufacturing

Advanced pcb design capabilities are a cornerstone of Chennai’s electronics ecosystem. Local companies specialize in multilayer PCB layout, high-density interconnects (HDI), and design for manufacturability (DFM), enabling efficient production and performance optimization.

PCB manufacturing units support these designs with precise fabrication, assembly, and inspection processes.

Trends Shaping the Electronics Manufacturing Industry in Chennai

IoT and Smart Devices: Increasing demand for connected devices is driving innovation in EMS and PCB design services.

Automation and Industry 4.0: Adoption of robotics and AI-powered quality control is enhancing manufacturing precision.

Sustainability: Growing focus on eco-friendly materials and energy-efficient manufacturing practices.

Export Growth: Chennai’s electronics exports are rising steadily, supported by favorable trade policies and global demand.

How to Choose the Right EMS Partner in Chennai

When selecting an EMS company in Chennai, consider the following factors:

Technical expertise in PCB design and advanced manufacturing technologies

Quality certifications such as ISO and IPC standards compliance

Manufacturing capacity and scalability to support your product lifecycle

Transparent communication and project management for smooth collaboration

Conclusion

Electronic manufacturing in Chennai is a thriving, well-supported industry with strong infrastructure, skilled talent, and innovative EMS providers. Whether you are a startup or an established company, Chennai offers a reliable ecosystem to develop, manufacture, and scale your electronic products efficiently.

Understanding the local capabilities in pcb design and EMS will help you make the best choices and accelerate your product’s journey from concept to market success.

#ElectronicManufacturing#EMSIndia#PCBDesignChennai#ElectronicsInChennai#PCBAIndia#SMTAssembly#ElectronicsManufacturingServices#PCBManufacturingIndia#ChennaiEMS#ManufacturingInChennai

0 notes

Text

HDI PCBs: The Backbone of Modern Miniaturized Electronics

In today’s fast-paced, technology-driven world, electronic devices are becoming smaller, faster, and more powerful. This evolution demands an equally advanced foundation to support it. That’s where HDI Printed Circuit Boards (HDI PCBs) come in. At Pcb-Togo Electronic, Inc, we specialize in crafting high-quality HDI PCBs that are not only compact but also deliver exceptional performance, reliability, and innovation.

What Are HDI PCBs?

HDI stands for High-Density Interconnect, a type of printed circuit board that offers a higher wiring density per unit area than traditional PCBs. These boards incorporate fine lines and spaces, smaller vias, and capture pads to maximize the efficiency of interconnections. HDI PCBs typically feature blind and buried vias and often utilize via-in-pad technology to further reduce space.

Their compact design and high-layer density make them the ideal choice for electronics where space and weight are at a premium, such as smartphones, tablets, wearable devices, and advanced medical equipment.

Why HDI PCBs Are Essential for Miniaturized Electronics

As electronic products shrink in size, the demand for lightweight, compact circuit boards with more functionality grows exponentially. HDI PCBs fulfill this demand by enabling the integration of more components within smaller footprints without sacrificing performance.

At Pcb-Togo Electronic, Inc, our HDI PCB manufacturing process focuses on precision and quality to ensure that every board can handle the demands of modern electronic devices. With tighter tolerances and enhanced electrical performance, HDI PCBs are engineered to meet the rigorous expectations of the industry’s leading innovators.

Go right here to explore how our HDI PCBs support high-speed signal transmission and minimize signal loss—two vital characteristics for devices where performance is non-negotiable.

Key Benefits of Choosing HDI Printed Circuit Boards

Compact Design

HDI technology allows for reduced board size by utilizing microvias and tighter trace widths. This not only saves valuable space but also helps decrease the overall weight of the end product—an essential factor in mobile and wearable electronics.

Improved Signal Integrity

The advanced layout of HDI PCBs reduces the signal paths, lowering the risk of signal degradation. At Pcb-Togo Electronic, Inc, we incorporate state-of-the-art techniques to maintain signal clarity, making our HDI PCBs ideal for high-frequency applications.

Higher Reliability

Fewer connection points and more direct routing result in enhanced mechanical and electrical performance. HDI PCBs manufactured by us are rigorously tested for durability and function under various stress conditions to ensure long-term reliability.

Faster Transmission

Shorter routing distances and lower cross-talk make HDI PCBs capable of faster signal transmission—vital for devices requiring real-time processing and responsiveness.

Design Flexibility

With multiple build-up layers and more complex stack-ups, designers have greater flexibility in incorporating intricate components. This freedom allows for innovation in product design and performance optimization.

Industries That Rely on HDI PCB Technology

HDI Printed Circuit Boards are not limited to consumer electronics. Their applications span across several high-tech industries, including:

Automotive electronics, where they enable the development of advanced driver assistance systems (ADAS) and infotainment.

Medical devices, such as wearable heart monitors and diagnostic tools that require miniaturized but reliable circuitry.

Aerospace and defense, where every gram and millimeter counts, and reliability is mission-critical.

Industrial automation, which demands robust and compact PCBs to support sensors, controllers, and IoT-enabled machinery.

Why Choose Pcb-Togo Electronic, Inc?

As a trusted manufacturer of HDI Printed Circuit Boards, Pcb-Togo Electronic, Inc combines technical expertise with customer-centric service. From rapid prototyping to large-scale production, we work closely with clients to deliver tailored solutions that align with their product goals.

We understand that time-to-market can be critical, so our streamlined production processes are designed to reduce lead times without compromising on quality. Plus, our engineers are available for technical support throughout the product development cycle.

You can find out more about our services and capabilities by visiting our website or contacting our customer support team directly.

Actionable Steps to Get Started

If you're an OEM, engineer, or product designer looking to upgrade your electronic products, consider the following steps:

Evaluate your current PCB needs – Consider the limitations of your existing designs and where HDI PCBs could enhance performance.

Consult with our experts – At Pcb-Togo Electronic, Inc, we offer free consultations to help you determine the best stack-up and layout strategy.

Request a prototype – Begin your journey with a prototype to validate the design before scaling up production.

Scale confidently – With proven quality assurance protocols, we ensure consistency in every production run.

Find Out More about how our team can help bring your next-generation product to life using cutting-edge HDI PCB technology.

Conclusion

In the world of modern electronics, precision, performance, and miniaturization are non-negotiable. HDI PCBs stand at the forefront of this transformation, and Pcb-Togo Electronic, Inc is proud to be a leader in this space. Our expertise in HDI Printed Circuit Boards ensures that our clients stay ahead of the curve with reliable, high-performance circuit solutions.

Whether you're developing the next smartphone or a critical medical device, partnering with us guarantees you access to the best in HDI technology. Go right here to connect with our experts and start your next innovation journey today.

Original Link: https://pcbtogo.blogspot.com/2025/06/hdi-pcbs-backbone-of-modern.html

0 notes

Text

Precision PCBA Solutions by SFXPCB: Global Excellence in Electronics Manufacturing

In today’s fast-paced technological world, PCBA (Printed Circuit Board Assembly) is a fundamental process that powers every modern electronic device—from smartphones and medical instruments to aerospace equipment and industrial control systems. As electronic design becomes more complex, the need for a reliable and precise PCBA partner becomes even more crucial.

At the forefront of innovation and quality in PCBA manufacturing stands SFXPCB, a global provider trusted by industries in Germany, USA, UK, Austria, and Canada. SFXPCB delivers high-quality assembly, superior engineering support, and efficient global logistics—all while maintaining competitive pricing.

What is PCBA?

PCBA (Printed Circuit Board Assembly) refers to the process of assembling electronic components onto a bare PCB (Printed Circuit Board). This process involves:

Applying solder paste to board pads

Placing surface mount or through-hole components

Reflow or wave soldering

Inspection (AOI, X-ray, or visual)

Functional and quality testing

The final product is a fully functional electronic board, ready for integration into a finished device.

SFXPCB – Your Trusted PCBA Manufacturing Partner

With a strong manufacturing base in China and a broad international customer base, SFXPCB provides end-to-end PCBA services tailored to meet the highest industry standards. From prototype assembly to mass production, their process is defined by precision, consistency, and speed.

Why choose SFXPCB for your PCBA needs?

✅ 1. One-Stop PCBA Services

SFXPCB provides a complete PCBA solution, including:

PCB fabrication

Component sourcing (including hard-to-find parts)

SMT & THT assembly

Functional and in-circuit testing

Quality assurance and packaging

This streamlined approach minimizes delays and errors, ensuring your projects run smoothly from start to finish.

✅ 2. Advanced Technology & Capabilities

Equipped with state-of-the-art SMT lines, reflow ovens, AOI systems, and BGA placement equipment, SFXPCB can handle:

Fine-pitch ICs

BGA, QFN, CSP components

High-density interconnects (HDI)

Rigid, Flex, and Rigid-Flex PCBs

Their advanced capabilities make them a top choice for industries demanding high precision and miniaturization.

✅ 3. Unmatched Quality Control

SFXPCB strictly adheres to ISO9001, RoHS, and UL certifications. Each project undergoes:

Automated Optical Inspection (AOI)

X-ray inspection (for BGA and hidden joints)

Manual inspection by experienced technicians

Functionality testing based on customer requirements

You can trust that every assembly meets the highest standards.

Industries That Trust SFXPCB’s PCBA Services

SFXPCB’s ability to handle complex projects and deliver on time has made it the preferred PCBA manufacturer for companies in:

🚗 Automotive Electronics

Reliable and rugged PCBA for engine control units, infotainment, and safety systems.

🏥 Medical Devices

Precision PCBA used in imaging systems, diagnostics, monitoring devices, and wearables.

📡 Telecommunications

High-frequency, high-speed PCBs used in routers, base stations, and IoT gateways.

⚙️ Industrial Automation

Durable assemblies for sensors, controllers, and factory automation systems.

🛰 Aerospace & Defense

High-reliability PCBA for communication, navigation, and surveillance applications.

Global Reach, Local Focus

Though headquartered in China, SFXPCB is a global player, serving clients in:

Germany

United States

United Kingdom

Austria

Canada

Their responsive English-speaking support team and efficient international shipping make it easy to work with them, no matter where you're located.

Fast Turnaround and Competitive Pricing

SFXPCB understands that time-to-market is critical. That’s why they offer:

Rapid prototyping services

Flexible volume production (from 1 to 10,000+ units)

Competitive pricing without sacrificing quality

Through strong relationships with component suppliers and efficient manufacturing practices, SFXPCB delivers high-value PCBA services at a cost-effective rate.

How to Start Your PCBA Project with SFXPCB

Getting started with SFXPCB is simple and fast:

Visit the website: https://sfxpcb.com/

Upload your Gerber files and BOM

Get a fast and accurate quote

Review DFM suggestions from their engineers

Approve and track your order online

You’ll benefit from responsive communication, transparency, and a seamless production process from quote to delivery.

Customer Testimonials

“SFXPCB is our go-to partner for PCBA. They consistently deliver high-quality boards and help us hit tight deadlines.” — CTO, IoT Startup (Germany)

“The team at SFXPCB is incredibly responsive and knowledgeable. We’ve trusted them with multiple projects and never been disappointed.” — Procurement Manager, Medical Device Company (USA)

Contact SFXPCB Today

Have a question or ready to place an order? Reach out directly:

📧 Email: [email protected] 📞 Phone: +86 0755 21012004

In the world of modern electronics, the importance of a reliable PCBA provider cannot be overstated. From prototyping to full-scale production, SFXPCB combines precision, speed, and service excellence to help businesses across the globe bring their products to life.

Whether you're an electronics startup or a global OEM, SFXPCB delivers quality you can trust—on time and on budget.

0 notes

Text

Printed Circuit Board Market Future Trends: Emerging Technologies and Growth Opportunities Driving Innovation

The printed circuit board market is witnessing significant transformation as innovation and technological advancements propel its growth. PCBs, the backbone of modern electronic devices, continue to evolve in response to emerging industry needs, consumer demands, and new applications. Understanding the future trends shaping the PCB market is essential for manufacturers, investors, and technology enthusiasts seeking to capitalize on opportunities and anticipate challenges.

One of the foremost trends in the PCB market is the increasing demand for miniaturization. As electronic devices become more compact and multifunctional, the need for smaller, lighter, and more efficient PCBs has intensified. This trend is especially prominent in sectors like consumer electronics, healthcare, and automotive, where space constraints and performance requirements drive innovation. Flexible PCBs and rigid-flex boards are gaining popularity as they allow intricate designs that fit into compact devices without compromising functionality.

Advanced materials are another crucial factor shaping the PCB market’s future. The traditional use of fiberglass and epoxy resins is gradually being supplemented or replaced by high-performance substrates such as polyimide, ceramic, and Teflon. These materials offer superior thermal stability, electrical performance, and mechanical strength, which are critical for high-frequency and high-speed applications. This shift supports the growing demands of 5G technology, aerospace, and military electronics where reliability under extreme conditions is vital.

The rise of 5G technology is a major catalyst driving the evolution of PCBs. The implementation of 5G networks requires PCBs that can handle high-frequency signals with minimal interference and signal loss. This has led to innovations in high-density interconnect (HDI) PCBs, which allow more components to be packed into a smaller area with enhanced electrical performance. The demand for HDI PCBs is expected to surge as 5G infrastructure expands globally, impacting telecommunications, IoT devices, and smart cities.

Sustainability and environmental concerns are increasingly influencing the PCB market’s future. The electronics industry is under pressure to reduce its environmental footprint, leading to the development of eco-friendly PCB manufacturing processes and materials. Lead-free soldering, recyclable substrates, and reduced hazardous chemical use are becoming standard practices. Companies that embrace green manufacturing are likely to gain competitive advantages as consumers and regulators prioritize sustainability.

Automation and Industry 4.0 integration are revolutionizing PCB manufacturing. The adoption of artificial intelligence (AI), robotics, and machine learning in production lines improves precision, reduces defects, and accelerates manufacturing cycles. Automated optical inspection (AOI) systems and real-time monitoring help maintain high-quality standards while reducing costs. This trend not only boosts efficiency but also allows manufacturers to respond swiftly to customized and small-batch orders, which are increasingly common due to diversified product demands.

The automotive industry continues to be a major driver of PCB market growth, especially with the rise of electric vehicles (EVs) and autonomous driving technology. PCBs in EVs must withstand higher temperatures and voltages while maintaining safety and durability. Advanced PCBs facilitate battery management systems, power electronics, and sensor integration crucial for EV performance. Additionally, autonomous vehicles rely heavily on sophisticated sensor arrays and computing power, all of which depend on innovative PCB designs.

Healthcare technology is another promising sector influencing PCB trends. The surge in wearable medical devices, telehealth solutions, and diagnostic equipment requires PCBs that offer reliability, miniaturization, and biocompatibility. Flexible PCBs enable comfortable and accurate wearable sensors, while multilayer PCBs support complex diagnostic devices. The ongoing digitalization of healthcare creates a continuous demand for cutting-edge PCB solutions tailored to medical applications.

Global supply chain dynamics also impact the PCB market’s future. The COVID-19 pandemic exposed vulnerabilities in electronics supply chains, prompting companies to rethink sourcing and manufacturing strategies. There is a noticeable trend toward regionalization and diversification to minimize risks and reduce lead times. This shift may result in increased investments in local PCB manufacturing capabilities, encouraging innovation and customization closer to end markets.

Another important future trend is the increasing use of embedded components within PCBs. Embedding passive and active components directly into the PCB substrate reduces assembly time, improves reliability, and enables higher circuit density. This technology is particularly valuable in compact and high-performance devices such as smartphones, tablets, and aerospace electronics, where every millimeter of space counts.

Lastly, the integration of PCBs with emerging technologies such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) will open new growth avenues. These technologies demand highly complex, lightweight, and reliable PCBs to support sensors, processors, and communication modules. As these applications gain traction across entertainment, education, and industrial sectors, PCB manufacturers will need to innovate to meet their unique requirements.

In conclusion, the printed circuit board market is poised for dynamic growth fueled by miniaturization, advanced materials, 5G adoption, sustainability initiatives, and Industry 4.0 automation. Key industries such as automotive, healthcare, and telecommunications will continue to drive demand for innovative PCB solutions. Manufacturers who embrace emerging technologies, invest in eco-friendly processes, and adapt to shifting supply chain models will be best positioned to thrive. As the market evolves, staying informed about these future trends will be essential for all stakeholders navigating the complex landscape of PCB technology.

0 notes

Text

How to Choose the Right PCB Manufacturer for Your Project

When you're developing a new electronic product, one of the most critical decisions you'll make is selecting a printed circuit board (PCB) manufacturer. A high-quality PCB is the backbone of any electronic device, and a reliable manufacturer ensures your designs are brought to life with precision, durability, and performance in mind. But with so many options available, how do you know which one is right for your needs?

In this guide, we’ll walk through the key factors to consider when choosing a PCB partner, what makes a manufacturer stand out, and how to avoid common pitfalls. Whether you're a startup working on a prototype or an established company moving into mass production, this article will help you make an informed decision.

Why Your Choice of PCB Manufacturer Matters

The PCB is not just another component—it’s the heart of your device. Poor-quality boards can lead to product failures, delays in production, and costly revisions. On the other hand, working with the right manufacturer can improve your product’s reliability, speed up development cycles, and even reduce costs.

This is why many professionals in the electronics space invest time in researching and partnering with trusted printed circuit board manufacturers who have a proven track record.

Key Factors to Consider When Choosing a PCB Manufacturer

1. Experience and Specialization

Not all PCB manufacturers are created equal. Some focus on low-volume prototyping, while others are geared toward high-volume production. Depending on your project, you should look for a manufacturer that aligns with your specific needs.

For example, if you're designing complex multi-layer boards, make sure the manufacturer has extensive experience in producing such designs. A company that regularly handles high-frequency or HDI (High-Density Interconnect) boards will be more equipped to handle advanced requirements.

2. Quality Standards and Certifications

Quality assurance is essential in PCB manufacturing. Look for certifications such as ISO 9001, UL listing, or IPC standards compliance. These certifications indicate that the manufacturer follows recognized best practices and quality control protocols.

Ask if they conduct Electrical Testing (E-Test), X-ray inspection, and other reliability tests. A manufacturer that prioritizes quality will always have robust systems in place to ensure each board meets the required specifications.

3. Production Capabilities

It’s crucial to understand the scope of what your manufacturer can offer. Can they handle the board sizes, layer counts, and materials your design requires? What about turnaround times for prototyping or mass production?

A good manufacturer will offer a clear breakdown of their capabilities, including:

Minimum and maximum board sizes

Supported layer counts

Material types (e.g., FR4, Rogers, etc.)

Surface finish options (e.g., HASL, ENIG, OSP)

Lead time flexibility

Having this information upfront helps you determine if the manufacturer can scale with your project’s needs.

4. Customer Support and Communication

Your relationship with a PCB manufacturer should feel like a partnership. Responsive communication and good customer support are essential, especially if issues arise during production.

Choose a company that provides clear, timely responses and is open to discussing your technical concerns. Ideally, you’ll work with a team that’s invested in helping you succeed—not just one that processes orders and moves on.

5. Pricing Transparency

Cost is always a factor, but the cheapest option isn't always the best. Look for manufacturers that provide detailed quotes, including breakdowns of tooling, materials, testing, and shipping. This ensures there are no surprises later.

You should also understand their pricing model—some manufacturers offer better rates for bulk orders, while others specialize in fast-turn prototypes at a premium.

Domestic vs. Overseas Manufacturers

A common question in the selection process is whether to go with a domestic or overseas manufacturer.

Domestic manufacturers often offer faster shipping, better communication, and easier quality control. They may cost more upfront, but the reduced risk and faster turnarounds can make up for it in the long run.

Overseas manufacturers, particularly in Asia, tend to offer lower costs. However, language barriers, longer shipping times, and quality control challenges can be drawbacks, especially for time-sensitive or high-precision projects.

That said, many printed circuit board manufacturers based in the U.S. or Europe now offer the best of both worlds—competitive pricing with high-quality standards and excellent customer service.

Red Flags to Watch Out For

Choosing the wrong PCB partner can result in production delays, increased costs, or even complete project failure. Here are some warning signs to watch for:

Lack of certifications or quality assurance processes

Poor or inconsistent communication

No clear information about production capabilities

Hidden fees or vague pricing

Limited reviews or a poor reputation in the industry

Always do your due diligence—read reviews, request samples, and even visit their facilities if possible.

Questions to Ask Before Committing

Here are some questions to ask when evaluating potential PCB partners: